How much should you charge?

Being creative is fun, but working out how much to sell our work for is not quite so exciting!

I have written a number of blog posts on this subject, but with many new people joining the world of balloons, I felt that this was a good time to revisit this topic!

I regularly see posts on Facebook asking for help with pricing and I know from my own experience that understanding how to cost your work is probably one of the more difficult aspects of running a balloon business. However, it is one of the most fundamental things you need to have at least a basic understanding of before you set up any business. Get it right the first time, and you’re well on your way to having a successful business. Get it wrong and you’ll either not make enough money to survive or you’ll be too expensive for your customers.

If an item is readily available at a variety of outlets, such as a carton of milk or a weighted helium -filled 18” foil balloon, then it will have a ‘market’ price. However, if it is a bespoke balloon sculpture, event decor, or even an elaborate arrangement, then pricing is not so straightforward.

Take your time to absorb this post, as it is full of important and helpful information, especially to first-timers! I have shared two great pricing tools that will help you with your pricing calculations, however, you still need to understand how to work out the different costs that you will need to include So please read through or watch the video's that I have attached to this post as each will also help greatly!

So how do we price our work?

Remember, the price that you charge may be VERY different from the price that another balloon company would charge and you will understand why very soon.

There is one simple rule to remember when pricing - make sure that you make money!

To be able to calculate a selling price we need to know the following things:

- How much our materials cost including helium (balloon gas), accessories and add-ons

- How much we need to charge per hour

- How much does it cost us to run our business (in other words, what is the overhead?)

- How much profit do we want to make

Material Costs

Material Costs should includes all the components that you have used in the design or decor that you have made. This includes balloons, balloon gas, accessories, etc. It is a good idea to create a cost sheet with unit cost prices for every single items you use, even down to the little glue dots you may use!

How much should you charge for your time?

Calculating an hourly rate for a self-employed person is not easy. Many people begin by looking at the hourly rates of people that are employed. However, the rate for a self-employed person cannot be equated in ANY WAY to the hourly rate of an employee, and here's why.

An employee (someone who is employed) will in most cases be compensated for some or all of the following

- Holiday/Vacation time

- Sick leave

- Work breaks

- Obtaining quotes for a customer

- Paid even when they have no work to do

- Is provided with a place to work

- Is provided with equipment, computers and all office supplies

- Employer contributes towards a pension

- Employer covers all the bills (heating, telephone, internet)

As a self employed person you will not get paid for any of the above and in addition:

- You need to pay for premises - unless you work from home

- You need to pay for business equipment (e.g. computers)

- You need to pay for insurances (e.g. public liability)

- You need to sort your own pension

- You need to pay all the bills

- You need to do your own marketing

- You need to pay accountancy fees

In the world of being employed by a company there’s a simple formula to calculating out an hourly rate: Take the annual salary, divide it by 2 and remove 3 zeros.

For example; If someone is earning £20,000 a year, they are roughly earning £10 per hour. If they earn £25 per hour, they roughly earn £50,000 a year.

If you want to make £20,000 per year from self employment you will need to charge more than £10 per hour. Remember, the rate that you pay yourself needs to include the time that you spend visiting clients, doing admin, sick days and holiday allowance... plus other expenses.

Check out these Self-Employed Day Rate Calculators to help you to determine how much you should be charging. I am sure that there are similar calculators that reflect employment rates in different countries. Check them both as they work slightly differently.

https://www.stepchange.org/debt-info/self-employed-income-calculator.aspx and https://www.freelancesolutions.co.uk/day-rate-calculator/

Running Costs and Overheads

This is the cost of running the business.

While overhead costs are not directly linked to profit generation, they are still necessary as they provide critical support for the profit-making activities. The overhead costs depend on the nature of the business. For example, a retailer’s overhead costs will be widely different from someone who works from home.

Some examples of overhead costs are:

- Rent

- Utilities (water, electricity)

- Insurance

- Office supplies

- Advertising expenses

- Accounting and legal expenses

- Salaries and wages

- Depreciation

- Government fees and licenses

- Property taxes

Overhead costs can include fixed monthly and annual expenses such as rent, salaries and insurance or variable costs such as advertising expenses that can vary month-on-month based on the level of business activity.

How do you calculate your overhead rate/percentage

To calculate the overhead rate, divide the total monthly overhead costs of the business in a month by its monthly sales. Multiply this number by 100 to get your overhead rate.

For example, say your business had £1,000 in overhead costs in a month and £5,000 in sales.

Overhead Rate = Overhead Costs ➗ Sales

The overhead rate is £1,000 ➗ £5,000 = .2 or 20%

This means that the business spends twenty pence on overheads for every pound that it makes.

Profit

Making a profit is vitally important for the growth of your business.

The term Gross Profit is the Overhead % and Net Profit % added together

The term Net Profit is a company's profit after all of its expenses have been deducted from revenues.

What net profit margin should a UK small business aspire to make in the UK?

A good margin will vary considerably by industry and size of business, but as a general rule of thumb, a 10% net profit margin is considered average, a 15% - 20% margin is good and a 5% margin is low.

In the balloon industry we generally use a Job Cost Form. The job cost form is a manual tool that will help you to calculate a selling price.

Here is an example of a Job Cost Form that I completed for a design that I made some time ago.

Now for the good news! There are now two Interactive Pricing Tools that I am aware of. These tools were created and shared by two UK Balloon Wholesalers. With both of these tools, you can easily work out the prices you should be charging for a product, service or decorating job. You will need to input materials, quantities and costs and then a total cost will be calculated for you. Adding in labour and other expenses, you can accurately come up with a direct cost for your job. From this figure, the tool then works out a selling price for you based on your desired level of profit and assumed overheads.

Balloon Market Interactive Pricing Tool

There is also a Formula for Manual Pricing – This is a little guide on how to work out costs and selling prices. The numbers correspond to the boxes on the Manual Pricing Tool.

And to help you with your helium pricing, there is a Helium Calculation Sheet – This sheet is to work out your helium costs. All you need to do here is enter in what you have paid for your cylinder and the rental charges (if applicable), and the sheet will do the rest of the work for you. You can then transfer these costs into the Interactive Pricing Tool or Manual Pricing Tool.

To download this tool follow this link: https://www.balloonmarket.co.uk/interactive-pricing-tool

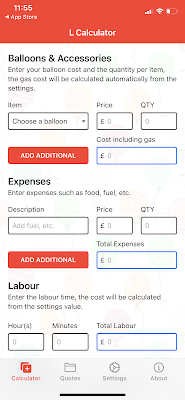

The other Pricing Tool is an App that has been created by Greetings House that you can use on your iPhone and is available from the App store, just search Greetings House. You are able to change the values and currency in the setting easily.

Here are two excellent videos that I believe will also help you to understand pricing a little better. The first one is from Balloon Market with Mark Drury of Qualatex Europe. Mark has helped countless balloon businesses work out the correct costings for their decorations and has given a lot of people the confidence to price correctly. Please note that this video was filmed in 2017 and prices quoted may differ.

They show how to easily find the minimum sale price of your balloon work, as well as what happens when you discount your work, and how it affects your bottom line. They also demonstrate how to ensure you are pricing for profit and not just turning over money. Remember: Turnover is vanity, Profit is sanity & Cash Flow is reality! For the links that they mention visit https://www.youtube.com/watch?v=hXayX0IriPo&t=478s or click HERE

Comments